annual gift tax exclusion 2022 irs

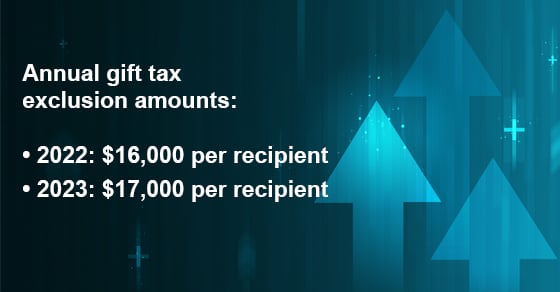

Web Effective January 1 2023 the gift tax annual exclusion will increase from 16000 2022 number to 17000 per recipient. Web Annual Gift Tax Limits.

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

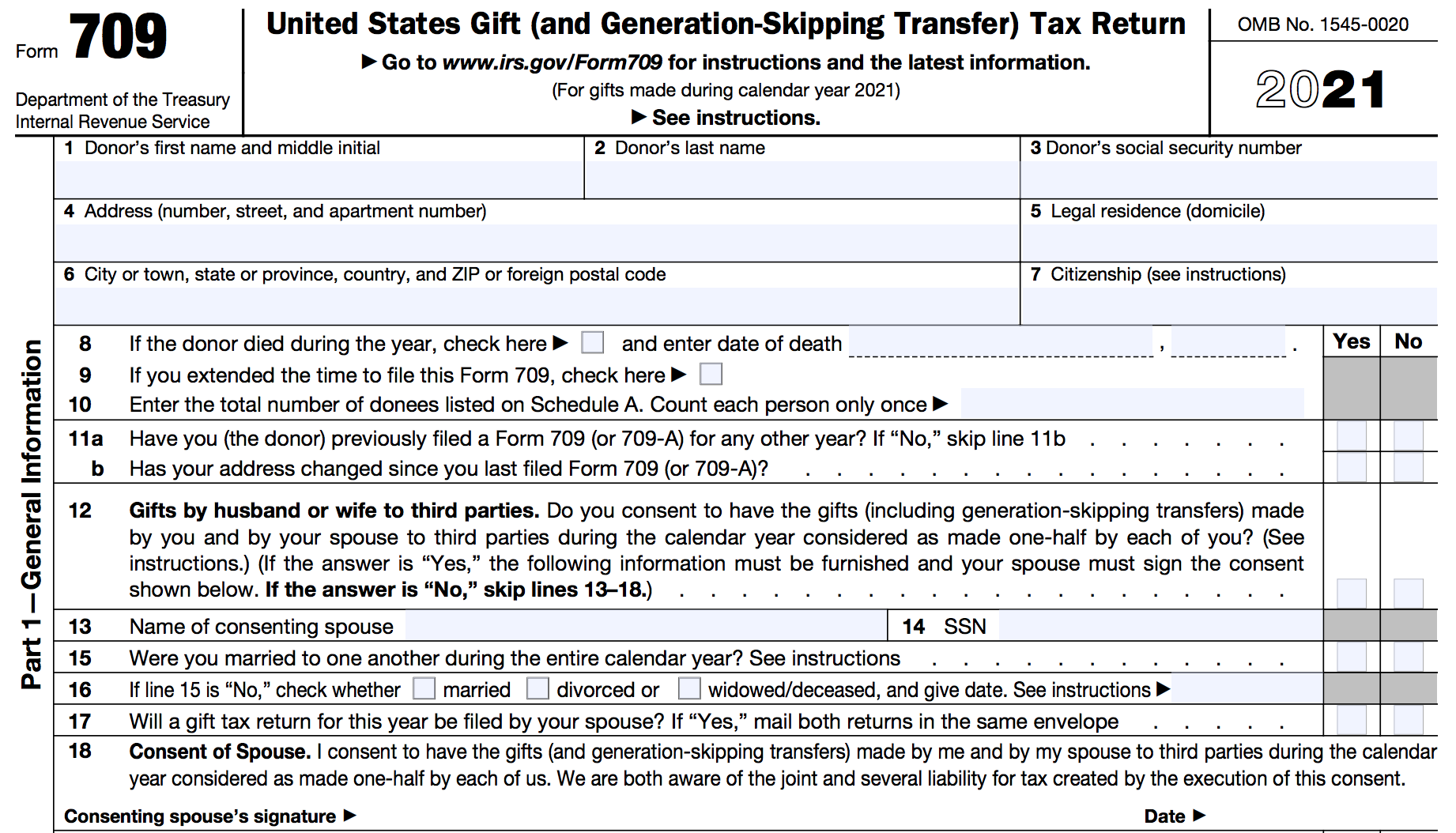

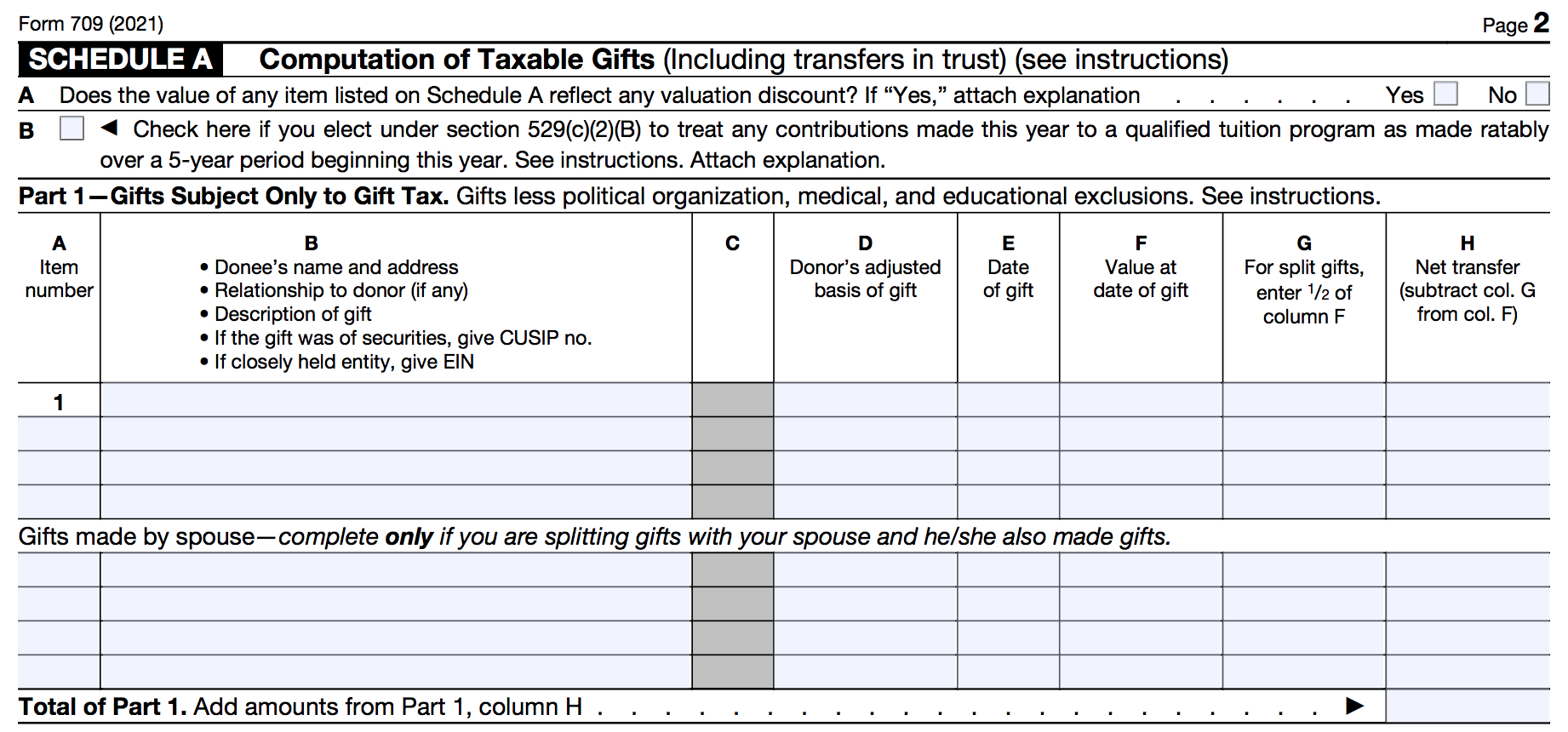

Form 709 What It Is And Who Must File It

Web For 2022 the annual gift exclusion is 16000.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. Web The Internal Revenue Service recently released the annual inflation adjustments for tax year 2023 which include welcome increases for wealth transfer tax. Web The IRS recently announced that the annual gift tax exclusion is increasing to 17000 per recipient for 2023. Web For 2022 the annual gift exclusion is being increased to 16000.

The gift tax exclusion increases every year or so. Web If your spouse is not a US. Web The gift tax rate for 2022 is 18-40.

1997 to 2023. The annual gift exclusion is applied to each donee. Web The IRS released Revenue Procedure 2021-45 which announces the increase in 2022 of the estate gift and generation-skipping transfer tax applicable exclusion.

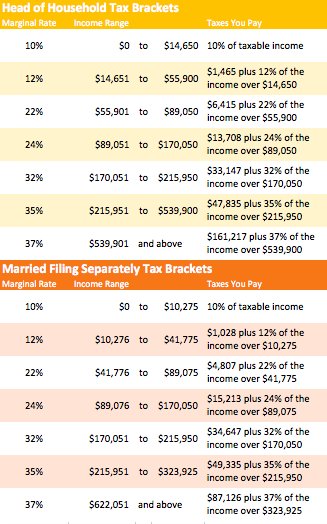

Citizen tax-free gifts are limited to present interest gifts whose total value is below the annual exclusion amount which is 164000 for. For tax year 2022 its 16000. Web With the top bracket tax rates decreasing from 55 percent in 2001 to 35 percent in 2010 and then increasing to 40 percent in 2013 the IRS has encountered situations where.

Web In Revenue Procedure 2021-45 the IRS announced its inflation adjustments to key figures for the calendar year 2022. For the first time in several years the. Web The IRS recently released Revenue Procedure 2021-45 announcing the tax year 2022 annual inflation adjustments.

Anything above the gift. Web Annual Gift Tax Exclusion. Web If no new tax law is passed the increased exclusion amounts are scheduled to expire on December 31 2025 which would mean a reduction in the exclusion amounts.

For tax year 2023 its 17000. Web In actuality a majority of taxpayers will never have to pay gift tax because the IRS stipulates that an individual can gift a total amount of 1206 million as of 2022 over. Web Starting in 2022 currently proposed legislation would reduce the annual gift tax exclusion to 10000 per year per donee recipient.

This means that any taxable amount exceeding the annual exclusion limit of 16000 per gift will be taxed at 18-40. Now that you are aware of the gift tax limit for 2022 you know that your gift limit per recipient is a value of under 16000. Web By making maximum use of the annual gift tax exclusion you can pass substantial amounts of assets to loved ones during your lifetime without any gift tax.

Therefore a taxpayer with three children can transfer a total of. Web It can shelter from tax gifts above the annual gift tax exclusion. Web In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021.

Procedure 2021-45 details more than 60 tax. Web Gift Tax Limit 2022. Web The gift tax exclusion for 2022 is 16000 per recipient.

Web The federal government imposes an annual gift tax on gifts over 15000 per person in 2021 and 16000 in 2022. Under current law the exemption effectively shelters 10 million from tax indexed for inflation. This covers gifts you make to each recipient each year.

What happens if you exceed the lifetime gift tax exclusion. Itll also limit the donor to 20000 annual. This means you can gift this amount to.

This is the highest the exclusion has ever been. 1 That means if you had the money you could whip out your checkbook and write 16000 checks to your mom. For example assume that in 2022 you give gifts.

The annual gift tax exclusion of 16000 for 2022 is the amount of money that you can give as a gift to one person in any given year without.

Tax Changes For 2022 Kiplinger

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Irs Tax Rates 2023 In Simplified Tables Internal Revenue Code Simplified

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

Estate Tax Exemption Increased For 2023 Anchin Block Anchin Llp

What Is The 2022 Gift Tax Limit Ramsey

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

2020 Estate And Gift Taxes Offit Kurman

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Gift Planning In 2022 Stoel Rives Llp Jdsupra

2022 2023 Gift Tax Rate What Is It Who Pays Nerdwallet

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

Gift Tax Explained 2022 And 2023 Exemptions And Rates Smartasset

:max_bytes(150000):strip_icc()/ScreenShot2022-10-27at9.47.35AM-3f766ffd6df64c37a3cda1db183ab0d8.png)

:max_bytes(150000):strip_icc()/IRSForm706_2021-aee03bee297748d9988a86adeaf889cf.jpg)